As the UK works to achieve net-zero emissions by 2050, the energy efficiency of people’s homes is under heavy scrutiny right now.

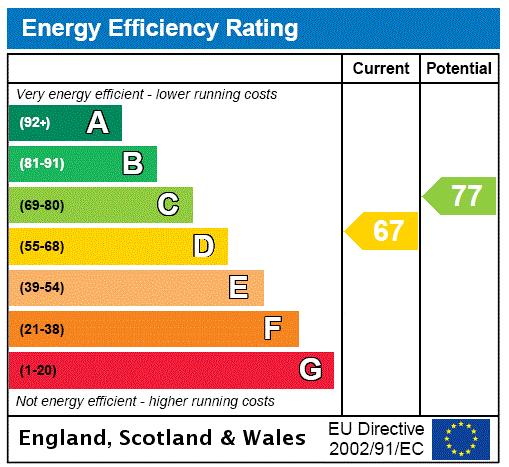

The government is currently consulting on updating the rules that govern the minimum EPC rating of rental properties. Currently, properties are required to have a minimum Energy Efficiency rating of an E, to both let the property and to use it to secure a mortgage. However, by 2025 this will be either raised to a D or C, with the majority of industry experts expecting the latter.

2025 may seem way off, but will soon arrive. The problem on the horizon is many landlords don’t actually know that this change is on its way or even under consideration.

A study conducted by Shawbrook Bank showed that a large proportion of landlords own older properties, with 36% saying their rental homes were built prior to 1940. This may cause issues as older homes generally have lower EPC ratings and will need to have costly work to become fit to rent and therefore acceptable to a mortgage lender post-2025.

At the bottom of your EPC you will see suggestions on how to improve your EPC rating.

We recommend you check your EPC rating and begin consulting on the cost of improvements. .

It is likely builders and other tradespeople will be mighty busy (that’s busier than they already are) as we approach deadline day as properties not achieving the expected C rating will not be either lettable nor mortgageable.

EPC’s are valid for 10 years, if you don’t have a current one, please make contact with Amy, Head of Property Management (020 8591 9088), and we can arrange one for you.